The Australian Taxation Office (ATO) is alerting taxpayers that its sights are set on work-related expenses like car and travel claims that are predicted to decrease in this year’s tax returns.

Assistant Commissioner Tim Loh said: “We know many people started working from home during COVID-19, so a jump in these claims is expected.

“But, if you are working at home, we would not expect to see claims for travelling between worksites, laundering uniforms or business trips.

“While it’s good to see most people have been doing the right thing, our data analytics will be on the lookout for unusually high claims this tax time. Particularly where someone’s deductions are much higher than others with a similar job and income.

“We will also look closely at anyone with significant working from home expenses, that maintains or increases their claims for things like car, travel or clothing expenses.

“You can’t simply copy and paste previous year’s claims without evidence.

“But we know some of these unusual claims may be legitimate. So, if you explain your claim with evidence, you have nothing to fear.

“We also want to reassure the community that we will be sympathetic to legitimate mistakes where good faith efforts have been made. However, where we spot people deliberately claiming things they’re not entitled to, we will take firm action,” Mr Loh said.

During 2020, the ATO had to shift focus on getting stimulus benefits out of the door as quickly as possible to support businesses in need.

In 2021, they state they will be continuing to balance their role in supporting taxpayers through this very challenging time, while recommencing their focus on addressing overclaiming of work-related expenses.

How COVID-19 has changed work-related expenses

- Working from home expenses

The temporary shortcut method for working from home expenses is available for the full 2020-21 financial year. This allows an all-inclusive rate of 80 cents per hour for every hour people work from home, rather than needing to separately calculate costs for specific expenses.

All you need to do is multiply the hours worked at home by 80 cents, keeping a record such as a timesheet, roster or diary entry that shows the hours your worked.

Remember – the shortcut method is temporary. If you want to claim part of an expense over $300 (such as a desk or computer) in future years, you need to keep your receipt.

- Personal protective equipment (PPE)

If your specific duties require physical contact or close proximity to customers or clients, or your job involves cleaning premises, you may be able to claim items such as gloves, face masks, sanitiser, or anti-bacterial spray.

This includes industries like healthcare, cleaning, aviation, hair and beauty, retail and hospitality.

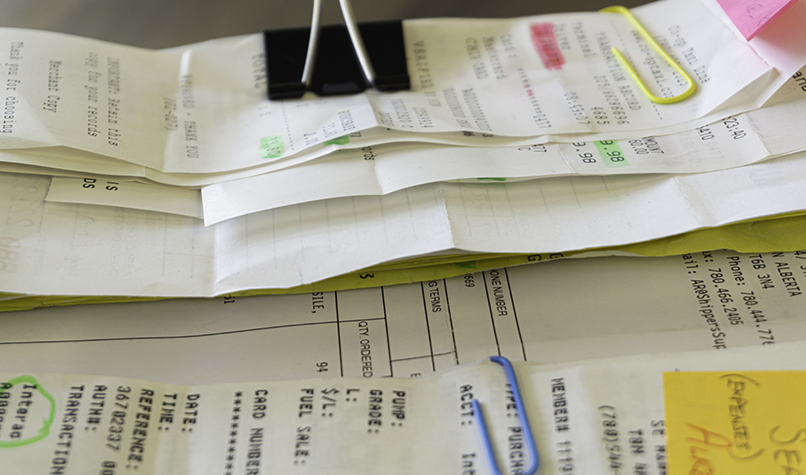

To claim your PPE, you’ll need to have purchased the item for use at work, paid for it yourself, and not been reimbursed. You also need a record to support your claim – a receipt is best.

- Clothing and laundry, self-education, car and travel expenses

In 2020, the ATO saw a decrease in the value of work-related expenses for cars, travel, non-PPE clothing and self-education as a result of the introduction of travel restrictions and limits on the number of people who could gather in groups. They expect this trend to continue in the 2021 tax returns.

If an employee is working from home due to COVID-19, but needs to travel to their regular office sometimes, they cannot claim the cost of travel from home to work as these are still private expenses.

TaxAssist Accountants are here to help you with all your tax and accounting needs. To book an appointment, please give us a call on 1300 513332 or use our online enquiry form.

We can offer initial consultations, advice and support over the phone if you have any concerns about face-to-face meetings.

Date published 25 Jun 2021 | Last updated 30 Jan 2026